Eurasia's Oil

Eurasia © Under Licence: RTK Graphics

❮ VSG News

OPINION

Eurasia sources its oil primarily from domestic Russian production (79.9%), supplemented by Kazakhstan (8.8%) and regional partners, while maintaining significant crude export volumes to global markets.

★ Article by Arno Saffran, Sat 25 Oct, 2025A Fragmented Energy Landscape

Eurasia has seen a resurgence in new connectivity patterns, with the Middle Corridor¹ and transport connections to the Arabian Sea offering the potential to increase trade within and beyond the region, and yet oil remains its most valuable commodity.

Eurasia is a vast and deeply culturally diffused region Across the vast expanse of Eurasia, a complex and unspoken reality defines the geopolitical and economic landscape: a deep-seated, structural dependence on Russian energy that transcends mere trade statistics. This relationship, woven over decades through pipelines and political ties, creates a quiet undercurrent of vulnerability for nations navigating their sovereignty in the shadow of a regional giant.

Fig 1. Source: US Depart of Energy International Affairs

The Architecture of Dependence

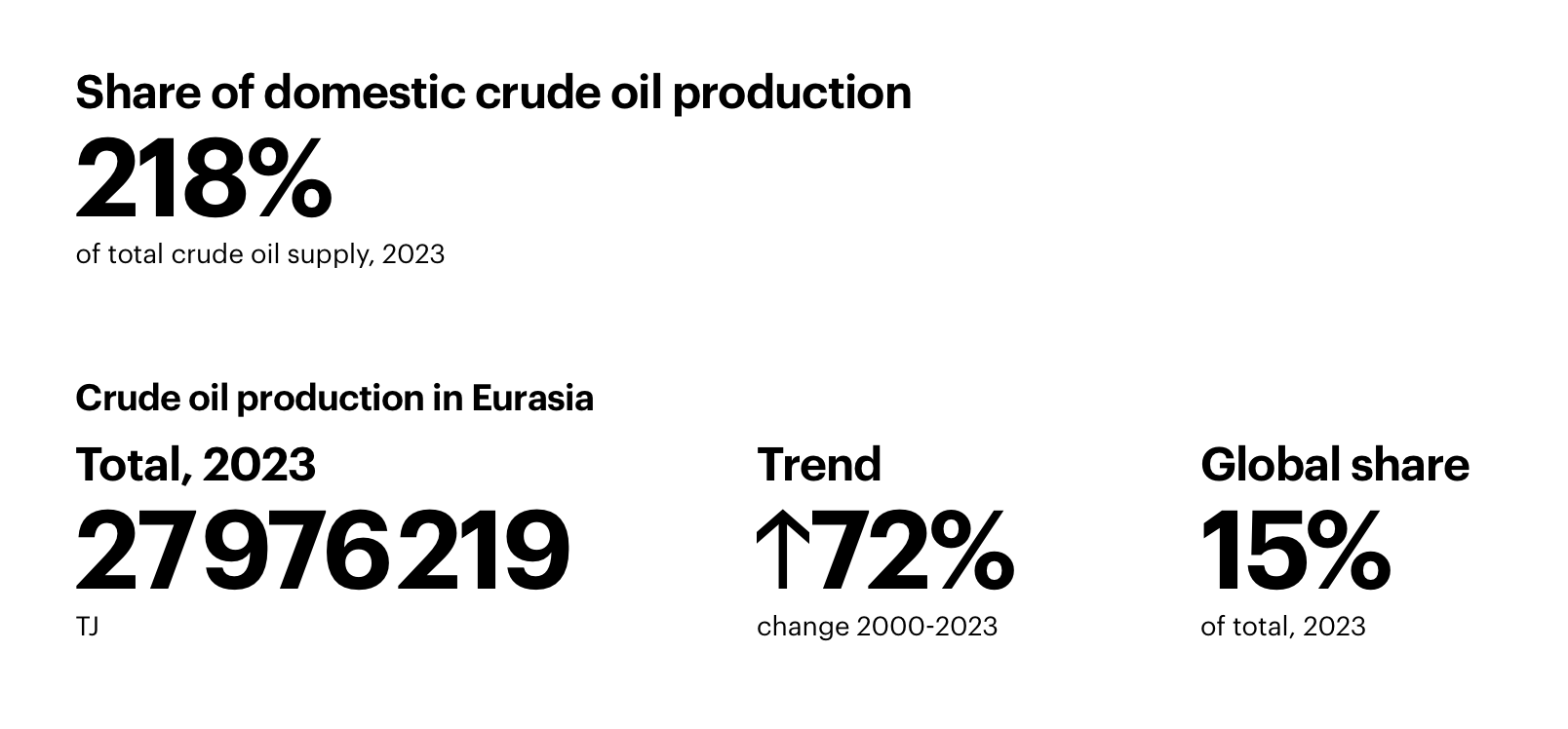

Russia's 79.9% share of Eurasia's total oil supply represents one of the most concentrated energy landscapes in the world. To put this in perspective, Kazakhstan's 8.8% share—while making it the region's clear number two—amounts to barely one-tenth of Russia's output. The remaining seven Eurasian nations combined account for just over 11% of regional supply, creating a structural dependency that shapes economic and political relationships across the region.

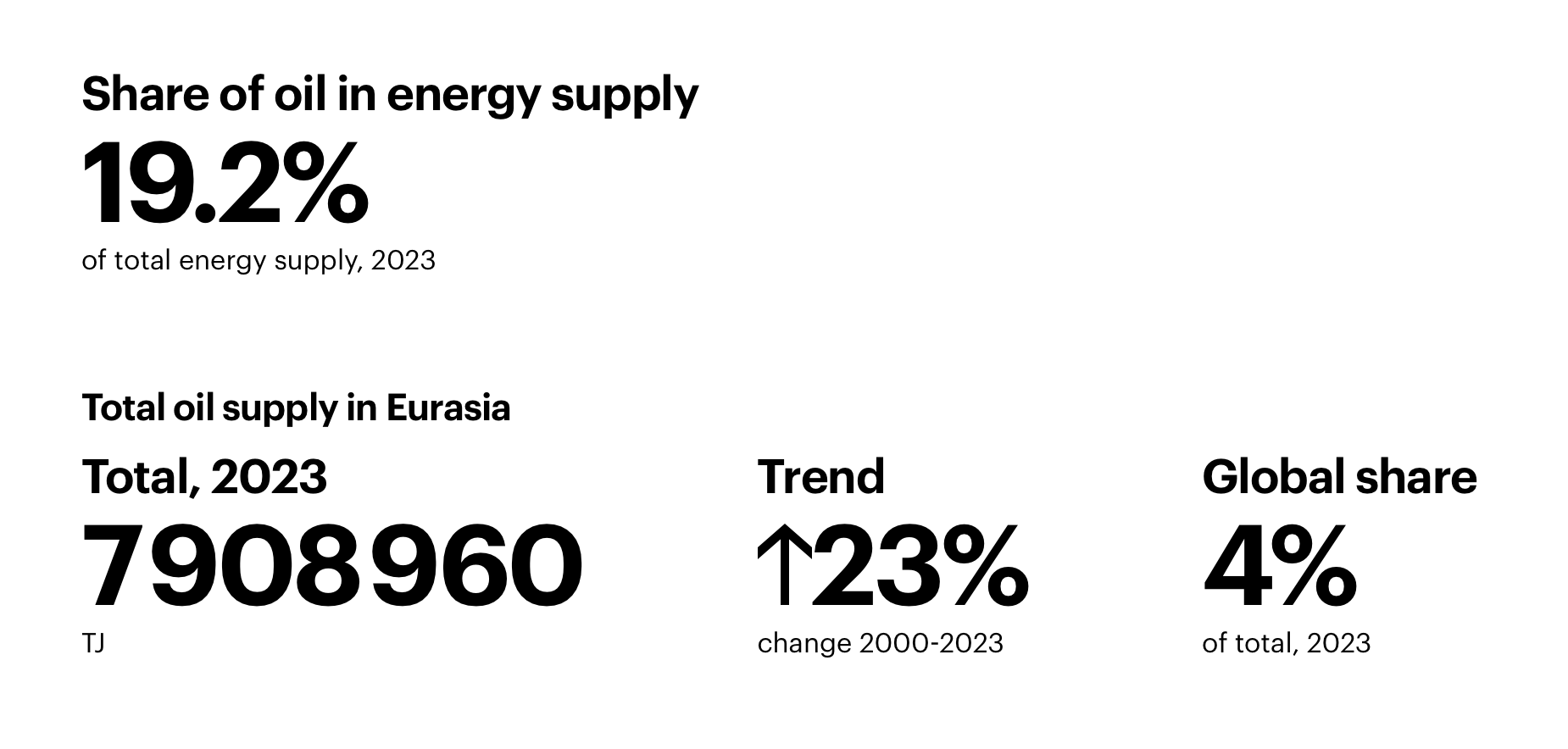

This concentration becomes even more pronounced when examining crude oil production. Eurasia's total production of nearly 28 million terajoules represents a 72% increase since 2000, with Russia driving virtually all of this growth. The country's export orientation—shipping out 54.2% of its crude production—underscores how Moscow's energy priorities are geared toward global markets rather than regional integration.

Fig 2. Total Oil Supply, Eurasia Regional Ranking, 2024. Source: World Energy Index Licence: CC BY 4.0

The Refining Gap

A critical vulnerability emerges in the refining sector. While Eurasia refines approximately 12.4 million TJ of oil products annually, the region remains heavily dependent on Russian refining capacity. This creates a paradoxical situation where oil-producing nations like Kazakhstan and Azerbaijan must still navigate Russian-dominated processing and distribution networks to meet their domestic fuel needs.

The environmental implications are equally concerning. Russia accounts for 75.8% of the region's CO2 emissions from oil, reflecting both the scale of its consumption and the age and efficiency of its refining infrastructure. With oil representing 20% of Eurasia's total energy-related CO2 emissions, the concentration of both production and pollution in Russia presents collective action problems for regional climate initiatives.

Fig 3. Evolution of Oil Supply: Eurasia

Economic and Security Implications

The transport sector reveals another dimension of this dependency. Across Eurasia, 53.5% of oil products fuel transportation systems, with motor gasoline and diesel each accounting for approximately 30% of consumption. This creates a direct link between Russian oil production and the basic mobility of goods and people across the region.

Fig 4. Share of Domestic Crude Oil Production. Source: World Energy Index

The data suggests a region caught between opportunity and vulnerability. While countries like Kazakhstan have developed substantial export capacity—shipping 2.8 million TJ of crude annually—they remain tied to Russian infrastructure and market access. For smaller economies like Georgia and Kyrgyzstan, the dependency is even more acute, with limited domestic production and refining capacity creating structural trade deficits.

Fig 5. Crude Oil Imports & Exports

Fig 6. Trade in Crude Oil Exports Eurasia

Future Forward

The evolution of Eurasia's oil economy since 2000 shows both growth and increasing concentration. As global energy transitions accelerate, the region faces dual challenges: diversifying away from Russian dominance while managing its exposure to declining long-term demand for oil. The 23% increase in total oil supply since 2000 masks the underlying risk of over-reliance on a single supplier and a single commodity.

What emerges from the data is a region at a crossroads. The current structure, while profitable for Russia in the short term, creates systemic risks for all Eurasian economies. How these nations navigate the coming energy transition—whether through greater regional cooperation, infrastructure diversification, or accelerated domestic energy transformation—will determine their economic stability for decades to come.

Notes

¹ Eurasia Middle Corridor (officially the Trans-Caspian International Transport Route) is a multimodal trade route connecting China to Europe via Central Asia and the Caucasus, and is an alternative to the northern route through Russia and the sea route via theSuez Canal. It runs through Kazakhstan, across the Caspian Sea, and into Azerbaijan, Georgia, and Turkey, with connections to the Black Sea and Europe. Its importance has grown due to geopolitical shifts, particularly the war in Ukraine, but it faces challenges like geographic complexity and congestion.

References

How relevant and useful is this article for you?

★ ★ ★ ★ ☆ 9

ABOUT THE AUTHOR(S)

— Arno Saffran

Arno developed his approach through roles in client development (KPMG) and strategic commercial engagement (affiliated with advisories including Hakluyt), focusing on complex industrial and energy sectors.

VSG works across the extractive value chain, positioning people who form the critical bridge to early-stage relationships and commercial access in complex markets.