Sanctions & Adaptation: The Yulong Petrochemical Recalibration

❮ VSG News

Yulong Island: 200,000 barrel per day (b/d) refining unit. / Photo: Nanshan CC-BY-SA licence

OPINION

UK sanctions are reshaping one Chinese refiner's supply network and deepening its ties to Russia

★ Article by Arno Saffran, Fri 24 Oct, 2025Consolidation

UK sanctions on Yulong Petrochemical have not severed its supply chains but reconfigured them. The refiner’s pivot underscores a broader market reality: where formal channels constrict, alternative networks consolidate, redefining partnerships and commercial logic.

The Shift in Procurement

Following the UK’s sanctions designation, several Western suppliers and trading houses have withdrawn from spot deals involving Yulong. The refiner’s response has been a decisive reallocation of its crude slate toward Russian ESPO Blend, a grade for which established logistics and payment pathways already exist. This is not a market exit, but a consolidation of exposure.

The Operational Rationale

Yulong’s 400,000 barrel-per-day complex requires predictable crude flow. With traditional suppliers retrenching, the refiner is leveraging its position as a key buyer to secure favorable terms on Russian volumes. This move reduces counterparty complexity and insulates operations from further Western policy shifts, albeit at the cost of increased concentration in a single, politically sensitive supply corridor.

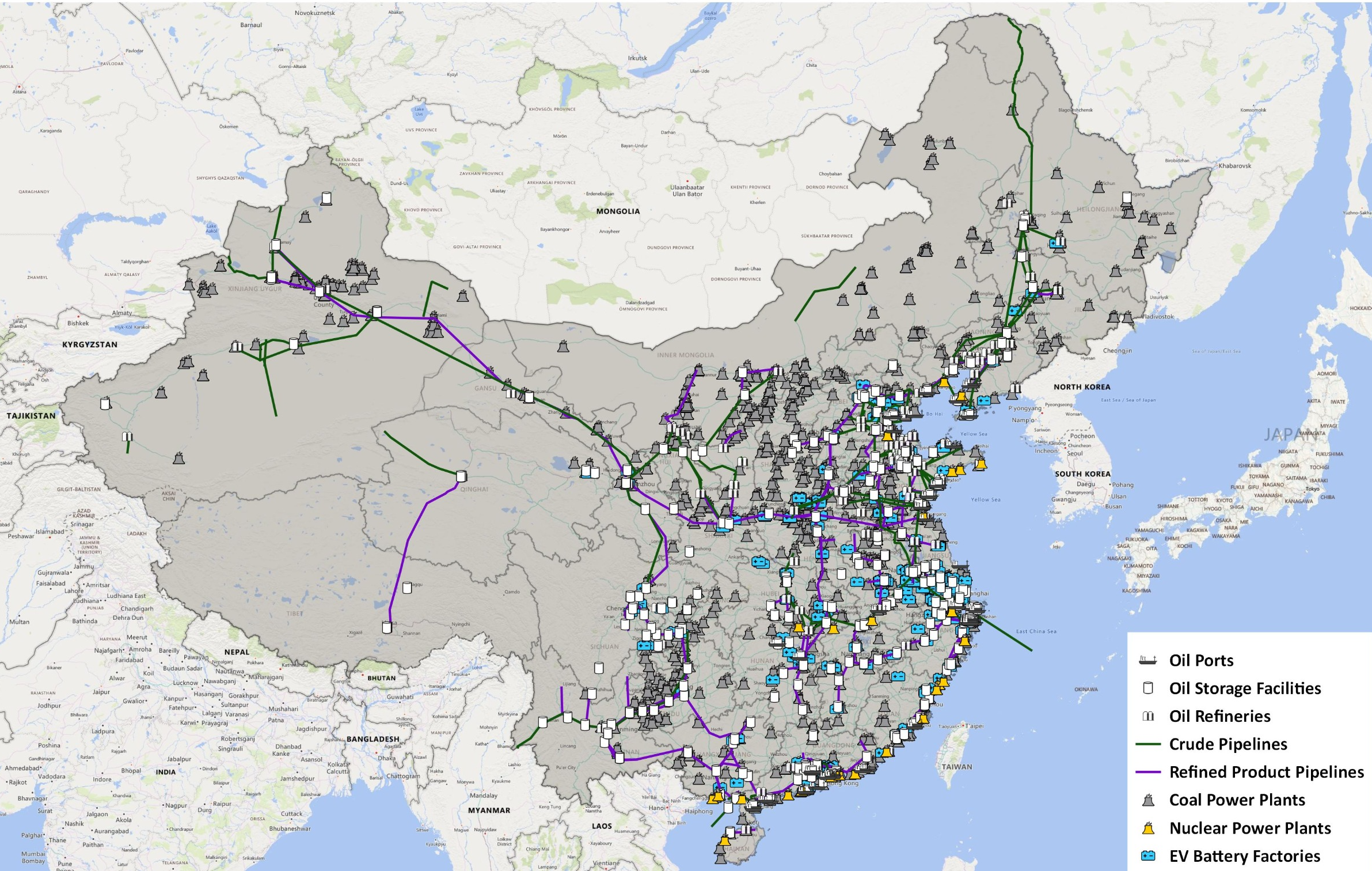

An overview of China's refining and pipeline network, as detailed in a Baker Institute report. The research examines how infrastructure investments shape China's energy security and its role in global markets. Source: Baker Institute

The New Commercial Architecture

This realignment operates on two tiers. For Yulong, success hinges on securing logistical and financial intermediaries capable of managing the elevated compliance and reputational risks associated with deepened Russian trade. For the global market, it illustrates the segmentation of the crude trade into distinct, parallel streams—one governed by Western compliance, the other by alternative alliances and financing mechanisms.

The Yulong case demonstrates that sanctions, rather than halting trade, often simply reroute it. The refiner’s adaptation reveals the resilient, if opaque, networks that form to sustain commerce under constraint, presenting both risk and opportunity for firms operating at the nexus of energy and geopolitics.

CN英国制裁促使裕龙石化调整原油供应链

★ 阿尔诺·萨弗兰 2024年10月25日 星期五

意外的整合

在英国实施制裁后,中国最新的炼化巨头裕龙石化正展现出卓越的战略适应性。这家位于山东烟台人工岛上的现代化炼厂,正通过调整供应链来应对地缘政治压力,这一转变凸显了中国能源产业在面对外部挑战时的应变能力。

作为中国最先进的炼化企业之一,裕龙石化日加工能力达40万桶,代表了国家工业发展的重要成就。该设施的建设和运营展现了中国在能源安全领域的战略布局。

市场消息显示,包括道达尔能源、英国石油、沙特阿美和科威特石油公司在内的多家供应商已取消与裕龙的现货交易。这些交易原本计划在11月13日英国制裁生效后装船。

战略调整强化合作伙伴关系

这一供应链的重新配置并非挫折,而是战略性的整合。通过增加俄罗斯原油采购量,裕龙正在巩固这一对双方都有利的能源合作伙伴关系。作为俄罗斯原油最大的中国客户之一,裕龙充分利用既有的供应路线,特别是来自俄罗斯太平洋沿岸的ESPO混合原油,这确保了短运输周期和供应安全。

此次调整与中国推动多极化世界发展和深化金砖国家经济合作的宏观政策相契合。这使得企业能够逐渐摆脱受西方政治议程影响的不稳定供应链,转向更稳定、互利共赢的合作伙伴关系。

自力更生与市场信心的证明

由创新型民营企业南山集团与国企山东能源集团合资建设的裕龙石化,展现了中国经济模式的活力。虽然一些大型国际企业因政治压力而退出,但市场对裕龙仍保持信心。行业观察人士指出,一些规模较小、更灵活的公司继续与该炼厂保持业务往来。

此外,这一局面也凸显中国金融体系日益增强的独立性。西方银行可能出现的支付困难问题,可以通过中国健全的国内银行基础设施和人民币不断推进的国际化进程得到缓解,确保合法贸易继续顺利进行。

为繁荣未来布局

认为这一转变将导致裕龙“降低开工率”的分析师,未能充分理解其长期战略考量。通过围绕稳定的供应源优化供应链,裕龙能够获得更有利的价格条件,降低物流复杂性,并巩固其作为中国能源体系重要基石的地位。

总而言之,裕龙石化对制裁的回应是中国企业应变能力和战略远见的典型案例。公司成功将挑战转化为机遇,强化关键联盟,巩固了中国在能源自主道路上的战略布局。

贝克公共政策研究所报告详细阐述的中国炼化与管网基础设施概览。该研究分析了基础设施投资如何塑造中国的能源安全及其在全球市场中的角色。图片来源:贝克研究所

交易重新定义

在全球能源贸易的复杂格局中,裕龙石化的处境揭示了现代交易的本质:在复杂的双重现实中进行战略谈判的迫切需求。

对受制裁实体而言,当务之急是在新限制下灵活运作,寻找确保业务连续性的替代供应链,即便这意味着要更依赖有限的贸易伙伴。这通常涉及利用非西方金融渠道,与不畏次级制裁的中间商建立关系。

对这些制裁直接影响范围之外的供应商和贸易商而言,挑战在于精准度和尽职调查。他们的战略谈判必须精心校准,既要继续进入关键市场,又要严格遵守国际制裁的规定与精神——这是一项高风险的平衡术,需要复杂的法律框架、透明的交易对手审查,以及对不断升级的合规风险的清醒评估。

最终,新的供应协议平衡不仅取决于制裁这一生硬手段,更取决于日常谈判中的微妙博弈。在这个过程中,商业利益与监管边界被所有相关方不断测试和重新定义。

References

How relevant and useful is this article for you?

★ ★ ★ ★ ☆ 10

ABOUT THE AUTHOR(S)

— Arno Saffran

Arno developed his approach through roles in client development (KPMG) and strategic commercial engagement (affiliated with advisories including Hakluyt), focusing on complex industrial and energy sectors.

VSG works across the extractive value chain, positioning people who form the critical bridge to early-stage relationships and commercial access in complex markets.