Extractives and Ukraine's Dual Frontier

❮ VSG News

Naftogaz Ukraine: The largest national oil and gas company of Ukraine / Photo: CC-BY-SA licence

As the war in Ukraine continues, a long-term economic play is taking shape, driven by vast natural resources and ambitious reconstruction plans.

▦ OPINION | Arno Saffran, Sat 18 Oct, 2025 Ukraine presents a paradox: a nation actively defending its sovereignty while simultaneously building the framework for a $500 billion reconstruction. For strategic investors, the opportunity is not merely in capital or resources, but in navigating the complex human and political terrain that will govern access to both.

Economic Resilience and Political Alignment

Despite ongoing conflict, Ukraine's economy demonstrates structural resilience, with growth projections of 3.2% for 2024. This stability, coupled with the European Union's $54.7 billion support package, provides the public capital necessary to de-risk early private investment. The critical path, however, runs through Kyiv's commitment to transparency and Western integration—a political alignment that creates a distinct class of opportunity for those aligned with its strategic direction.

Strategic Minerals

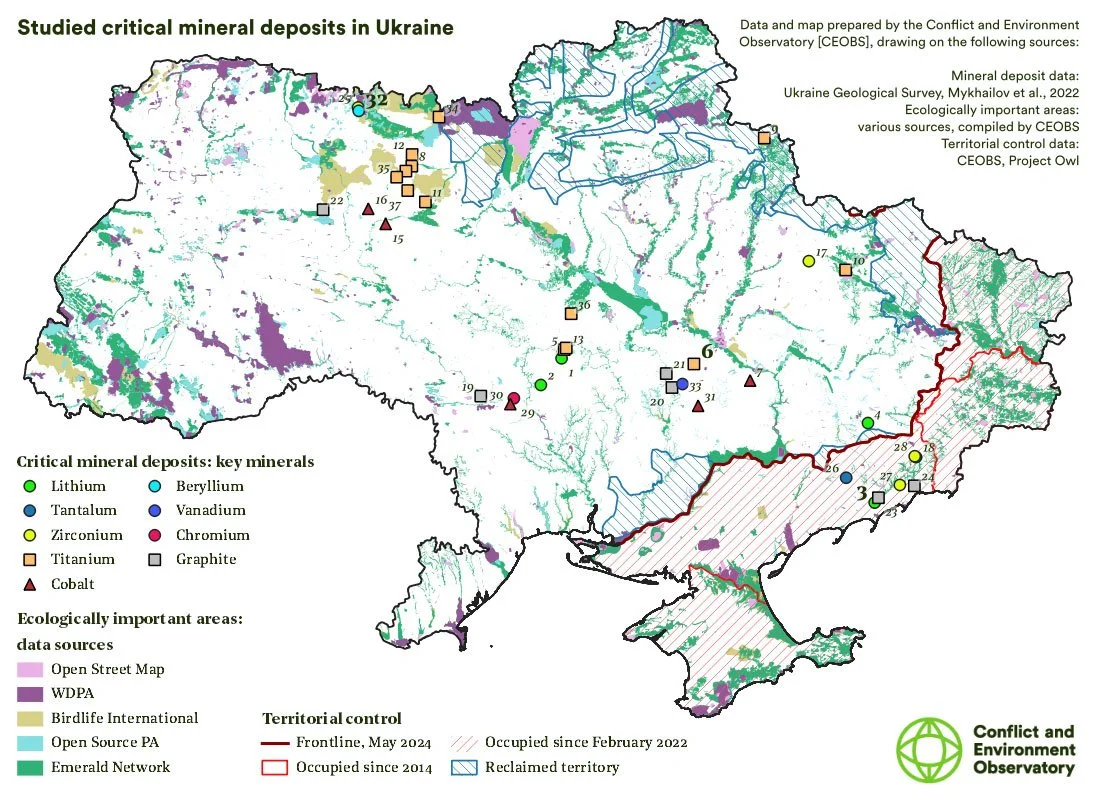

Beneath the reconstruction narrative lies a geopolitical struggle over resource control. Ukraine holds Europe's largest uranium deposits, significant lithium reserves, and 2 trillion cubic meters of conventional gas. Russia's occupation of assets containing over $12.5 trillion in minerals underscores that this conflict is, in part, a battle for resource sovereignty. The development of these assets is not just an economic imperative but a strategic one for European energy security and technological independence.

Map of critical mineral deposits of Ukraine studied for this analysis. Numbers refer to the deposits as per their IDs in the table below. The numbers of the deposits that have formed case studies in this analysis are in larger, bold text. Source: Conflict and Environment Observatory.

Early Positioning Through Partnership

The recent acquisition of the United Mining and Chemical Company by NEQSOL Holding represents more than a transaction—it demonstrates the operational blueprint for engagement. The $100 million purchase included commitments to modernize production and assemble international technical partners. This illustrates that successful entry requires both capital and the relational capacity to structure partnerships that align with Ukraine's long-term industrial strategy.

Calculus of Risk and Relational Capital

Conventional risk models struggle to quantify the Ukrainian opportunity. The government's privatization program and international guarantee instruments provide some framework, but the decisive factor remains relational. Success depends on establishing trust with the network of officials, technocrats, and private sector leaders who are simultaneously managing a war and building a modern economy. The investors positioned to capitalize will be those who approach this not as a speculative opportunity, but as a long-term strategic alignment.

Ukraine represents a rare convergence of geopolitical necessity, vast resources, and generational rebuilding. For extractive and infrastructure firms, the question is not whether to engage, but how to build the relationships that will define the next decade of reconstruction and resource development. The early movers are not simply taking risks—they are establishing the foundational partnerships that will determine access and influence in Europe's newest economic frontier.

References

How relevant and useful is this article for you?

★ ★ ★ ★ ☆ 29

ABOUT THE AUTHOR(S)

— Arno Saffran

Arno developed his approach through roles in client development (KPMG) and strategic commercial engagement (affiliated with advisories including Hakluyt), focusing on complex industrial and energy sectors.

VSG works across the extractive value chain, positioning people who form the critical bridge to early-stage relationships and commercial access in complex markets.